With a short lead up time to the recently announced Federal election on May 21, the uncertainty which often precedes elections is yet to appear across the commercial markets. Over the coming weeks we will hear more about the economy, inflation, and all things recovery in a post COVID-19 environment; none of which has brought hesitation by buyers and sellers to transact in the commercial real estate market..

While focus has been on interest rates and their anticipated upward movement, this will dampen activity for some buyers notably the smaller investor and self managed superfund buyers who have increased their spending over the past 18 months. While this smaller end of the market may see a period of moderation back to more normalised levels of activity, the abundance of cash rich investors and larger trusts, funds, as well as offshore buyers’ deep pockets, will see the continued strong investment into commercial property this year.

Foreign buyers continue to be active in both buying and selling commercial assets with early signs that this trend is set to continue despite the election and its outcome. The recent release of the FIRB Annual Report for 2020-21 has shown a 95.91 per cent increase over the year in applications to invest in Australian real estate. The 862 applications, which represents $82 billion in commercial property, is an opposite trend to what we have seen in the residential market, with $10.4billion approved down from $17.1 billion the previous year.

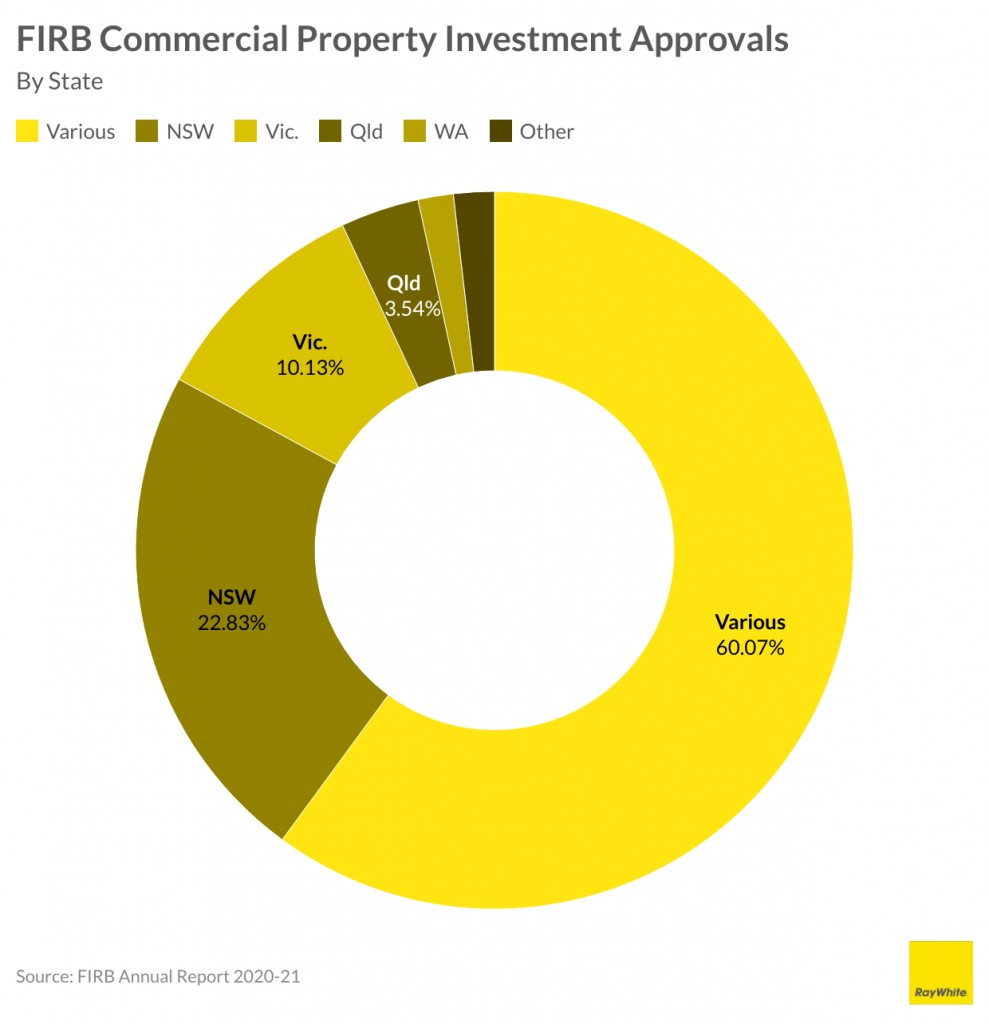

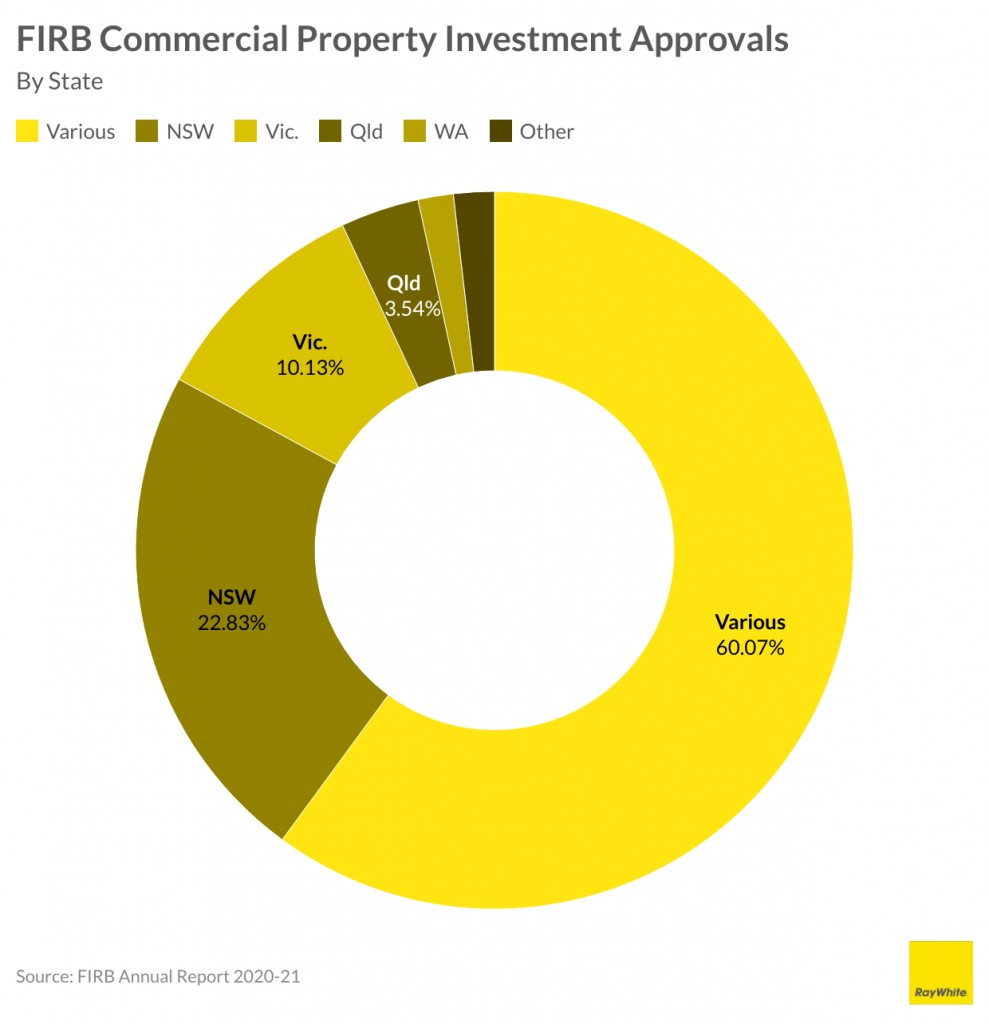

Commercial investment continues to be heavily weighted towards Sydney and Melbourne regions with strong volumes across all sectors notably the office market. The current uncertainty, particularly in CBD office markets, surrounding occupancy and rents is not a deterrent for these buyers who consider the yields on offer still competitive compared to other international markets, while the security and vibrancy of our global cities is a strong indicator of confidence and future growth. Greater interest in the Queensland market has come off the back of strong population gains notably in SEQ while the announcement of the Olympics in 2032 will do much to raise the profile of the state in coming years and draw greater interest.

Portfolio sales remains a key focus for international buyer groups looking for a larger foothold in the Australian market. We have seen more of this in the industrial sector notably for distribution/logistic assets and cold storage across all states which has been the outperforming asset type over the last 18 months.

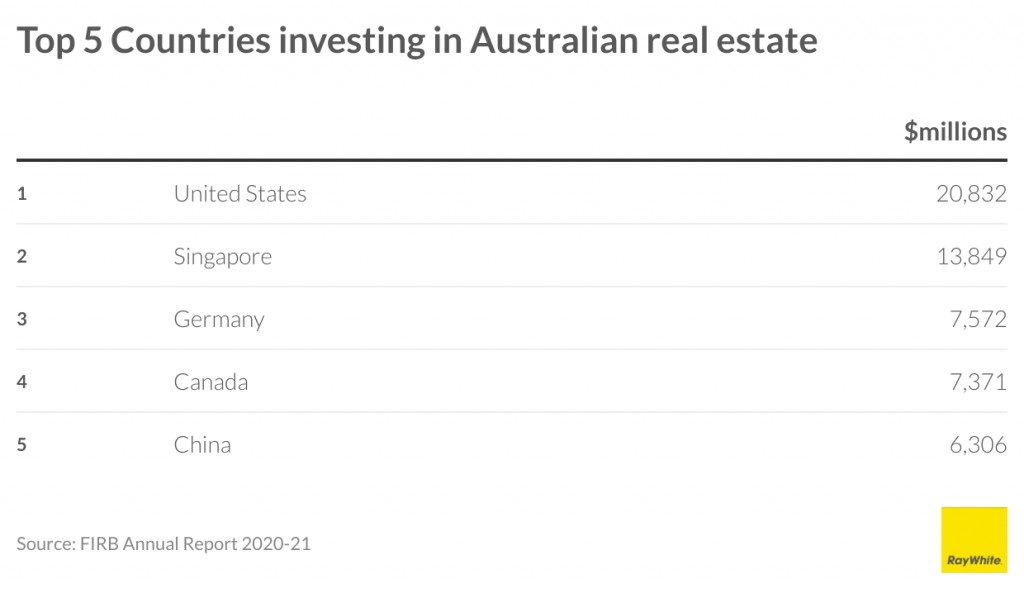

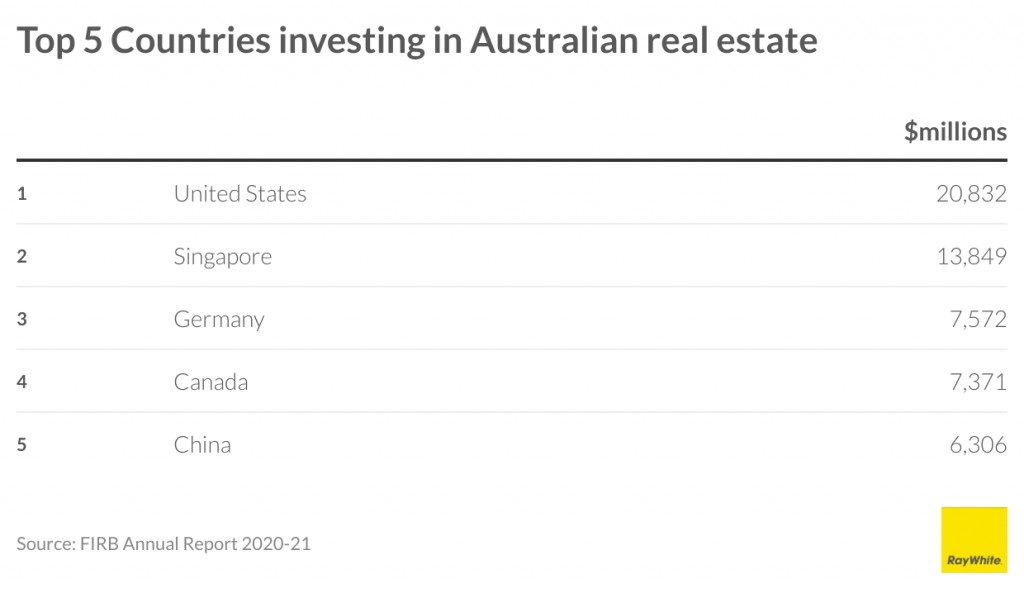

The countries seeking real estate investment into Australia have seen some change; USA, Canada, Singapore, China and UK historically have been big investors however this profile has seen some reweighting. While the USA remains the greatest investor followed by Singapore, we have seen Germany grow their interest after a number of years in hiatus notably in the office and industrial sectors. Large pension funds continue to see Canada as a key investor into Australian real estate while China has moved down the list during this year which has been largely influenced by a reduction in FIRB development applications in Australia as well as a halt to international students and migration which in the past has grown real estate sales (albeit residential). Looking at recent transactions in the early part of 2022 we can see that buyers from Asia have come back with Singapore, Hong Kong and Japan growing their interest while USA, Canada and European buyers continue to transact.